Led by digital platforms and increasing digitalization of manufacturing, energy and agriculture, the digital economy worldwide was 15.5 per cent of global GDP in 2016 and is projected to grow to 24.3 per cent by 2025. In addition, the development of a cloud-based, high-speed digital infrastructure is particularly critical for the development of jobs in urban areas positioned to be service hubs. A digital economy is indispensable to the development of the countries in the Middle East and North Africa (MENA). In this respect, citizens as well as SMEs in the region need affordable broadband internet and well-functioning digital payments to capitalize the digital opportunities created by this new economy. However, digital infrastructure in MENA lags other emerging regions and digital payments in some countries of the region see a slower diffusion. In addition, Internet speed is significantly slow. Internet access costs have decreased over the last three years, but they remain high, especially to the bottom of the pyramid. Many internet markets in MENA countries have monopolies or entry barriers, making MENA the region with the highest Internet market concentration in the world. Entry barriers limit internet infrastructure development and this constraint limits innovation across the whole internet value chain. Better connectivity, along with complementary regulatory measures, could develop data centers, unleash the potential of data intensive businesses, and help MENA in the transition towards a data-driven economy. The opportunity for the MENA Region to leapfrog by adopting ambitious targets of broadband development, broad diffusion of digital payments, and through a wide diffusion of technologies in the economy, is advocated by the new World Bank report "A New Economy".

In addition, new policy challenges are emerging with the growth of digital platforms, and policy-makers and regulators in MENA may face specific, additional challenges. Additional policy concerns are surfacing around the data economy, including privacy and security, and promoting a level playing field across the whole value chain of the data-enabled economy. In the new World Bank report "Information and Communications for Development 2018: Data-Driven Development", the main emerging opportunities and concerns around the development of a data-driven economy are analyzed. This think-piece aims at contextualizing the recommendations to be relevant to policy makers in MENA.

Broadband Internet as a Foundation of the Digital Economy

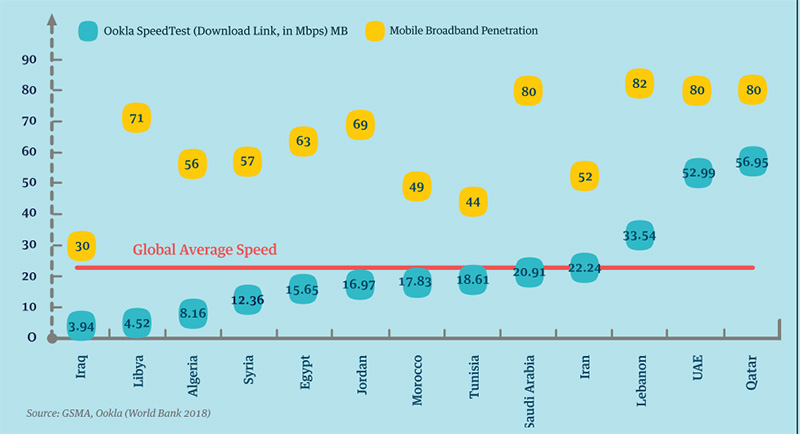

Mobile broadband uptake in MENA is more limited than in other regions, including emerging markets in East and Central Asia. Low quality is also an issue. Most MENA countries have mobile broadband speeds below the global average. These indicators show a good competitive dynamic on the mobile access side, the only market segment in the broadband value chain open to competition in most markets in MENA. Still, although competition led to a good expansion of basic voice service, underinvestment in the network infrastructure and limited use of the infrastructure built by other network utilities will limit future growth. Both 4G and 5G mobile networks need extensive fiber backhaul infrastructure.

Figure 1 – Mobile broadband penetration and speed in MENA

Figure 2 – Mobile broadband penetration and speed in MENA

MENA middle-income countries need a new growth engine to escape the middle-income trap. Information technology could provide a pathway for growth, especially for MENA countries, where there is a high level of human capital. A promising approach for MENA countries is to adopt a technology-based economic model that embraces innovation and encourages risk-taking and creativity.

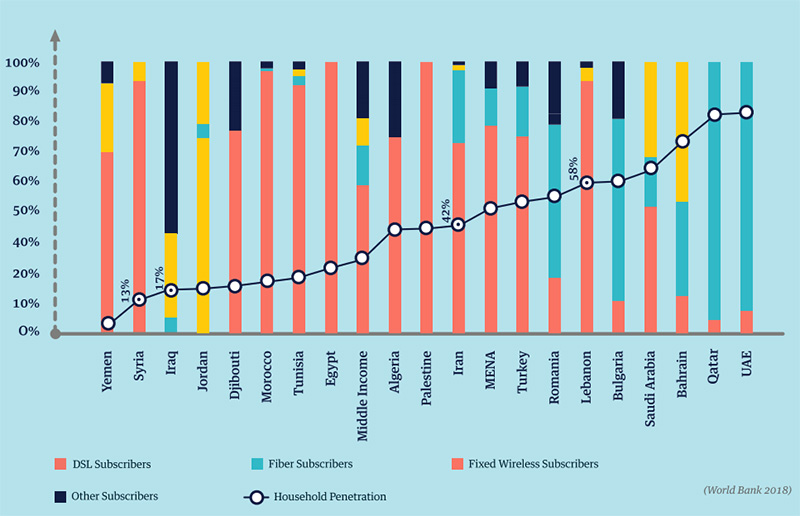

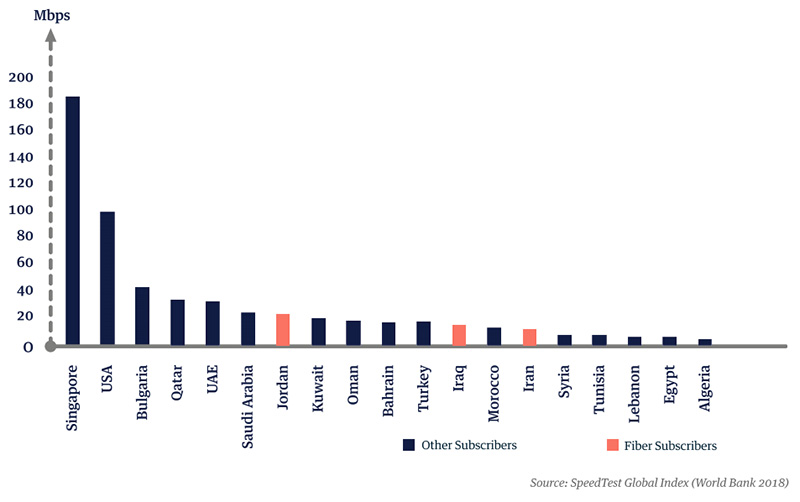

However, to achieve the transition to a technology-based economic model, other regions in the world have shown that the investment in high-speed internet is essential. Other regions are leading the way when it comes to massive adoption of fiber optic in the last mile. These differences in the infrastructure mix are shown by the technology mix for fixed internet access in MENA, compared to countries in Eastern Europe (Figure 2). Most MENA countries still rely on legacy technology—that is, copper wires—to get the internet to the end user, while countries like Romania and Bulgaria moved to a fiber access infrastructure. Only the UAE and Qatar use a fiber optic system to deliver the internet to the final user. As with mobile broadband, fixed internet speed in the Gulf is disappointing. None of the countries in MENA has an internet speed at par with global average. To illustrate the technology delay in the region, it is useful to compare, say, Bulgaria and Morocco. For example, Bulgaria has 1.7 times more broadband subscribers then Morocco. However, when we compare fixed broadband subscribers, the ratio between Bulgaria and Morocco increases to 6.7 to 1. And the ratio is 69 to 1 in the ultrafast, essentially fiber optic, segment. As countries like Romania and Bulgaria, among others, have laid the connectivity foundations for the digital economy (a few Romanian cities have an average internet speed higher than Paris, and the country’s average speed exceeds France’s), MENA countries rely on legacy infrastructure, slowly migrating the customer base from mobile voice to data.

Figure 3 – Internet Speed in MENA

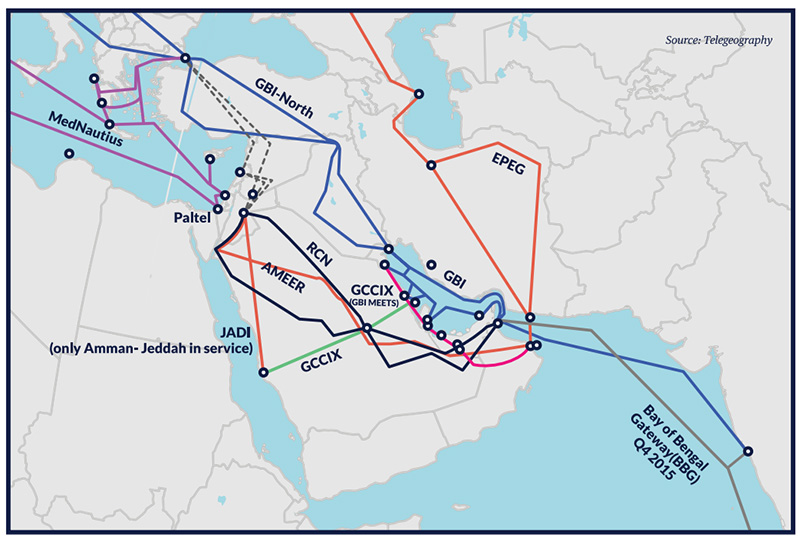

This lackluster performance in internet access is in contrast with an impressive endowment of fiber optic backbone networks (that connect one network to another). Most of the submarine cable infrastructure linking Europe and China crosses the Mediterranean Sea, the Sinai Peninsula, descends through the Red Sea and through the Yemen-Djibouti strait to reach the Arabian Peninsula and the Indian Subcontinent. This infrastructure is complemented by powerful land-based networks that cross the Mashreq, and provide alternative, high-speed routes.

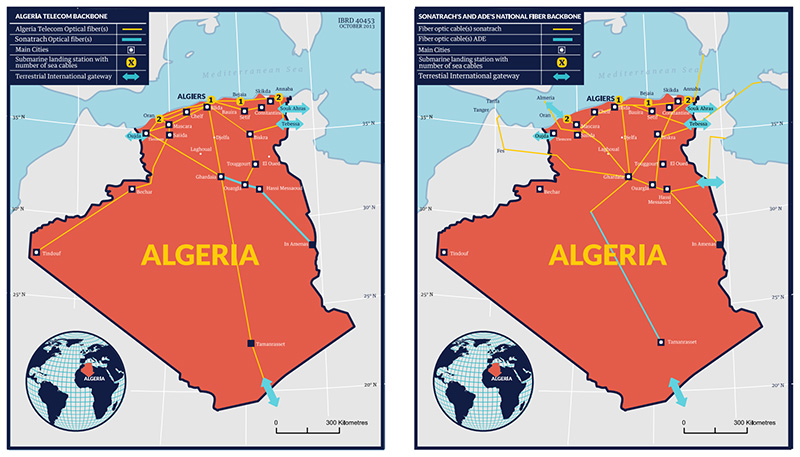

In addition, domestic utilities in MENA countries have often developed fiber infrastructure to serve their own needs. Many countries have the potential to leverage these terrestrial networks to complement the submarine connectivity. Countries like Egypt, Morocco, Algeria and Iraq could develop further their position as connectivity hubs. A country like Algeria has an impressive endowment of 75,000 kilometers of fiber optics, including Algerie Telecom and mobile operators, but also energy giants like Sonatrach and Sonelgaz. Were Algeria to connect this infrastructure to sub-Saharan Africa and the cables in the Mediterranean Sea, it could change the geography of the global internet infrastructure. And this position would complement and strengthen, not displace, the other existing connectivity hubs in the region.

Figure 4 – Algerie Telecom and Sonatrach Fiber Infrastructure. Source: World Bank, 2014, Telegeography, and Algeria Vision 2030.

Similar opportunities are also emerging in the global internet infrastructure supporting the data flows between Europe and Asia, the fastest growing data connectivity link in the globe. Stronger regional integration in the Mashreq, in particular, could spearhead the development of massive Internet backbone networks, and acting as regional hubs for connectivity and data.

Figure 5 – Terrestrial Networks in the Mashreq and Gulf. Source: Telegeography

Data and Digital Platforms: The Infrastructure of the New Economy

Many governments start recognizing that, as an infrastructure asset, data is on par with more traditional infrastructure like transport and public utilities. Indeed, stock exchanges place a much higher value on control of a customer’s data than control of infrastructure.

On the policy side, the conception of "data as an essential facility" is gaining momentum. Recent interest has therefore been in crafting policy that recognizes data as an infrastructure asset. These government policies typically focus on management of data assets (collection, access, reuse, sharing, preservation, security) and data governance (ownership, funding), though some also address storage (data localization, data center management). The same principles apply to private sector firms gearing up to develop data assets. In addition, governments need to facilitate the development of physical infrastructure to manage data from nontraditional sources that the current telecom infrastructure is not designed to support (IoT, for instance, or call data records). These policies are particularly important as the current wave of digital disruption has produced many winners that dominate the economic landscape.

The disruptors may soon become the disrupted, however, especially as even newer types of data sources emerge and firms with next-wave data skills develop new products and services. Other threats include the disruption of the current advertising-based models, which may suffer if more restrictive data policies become the norm and data ownership is contested in different societies. Others have theorized that decentralized technologies like blockchain might ultimately be the death knell for firms like Google or Facebook.

What does digital disruption mean for the economies of the region in terms of opportunities and risks?

This new competitive landscape has extensive implications for the economy in MENA. In most countries in the region, traditional, protected sectors like banks and telecoms, as well as the energy and extractive sectors, tend to dominate the economies in the MENA region. The OECD, in its submission to a Group of Twenty conference, provides useful background about the opportunity of the data economy: "As the cost of data collection, storage and processing continues to decline dramatically, ever larger volumes of data will be generated from the IoT, smart devices, and autonomous machine-to-machine communications". This will require a new approach to thinking about infrastructure in the twenty-first century, with the definition expanded to encompass broadband networks, cloud computing, and data itself, which drives productivity growth. In the United States, for instance, Brynjolfsson, Hitt, and Kim (2011) estimate that output and productivity in firms that adopt data-driven decision-making are 5 percent to 6 percent higher than what would be expected from their other investments in and use of information and communication technologies (ICTs). A study of 500 firms in the United Kingdom found that firms in the top quartile of online data use are 13 percent more productive than those in the bottom quartile. Overall, these firm-level studies suggest that firms’ use of data and data analytics raises labor productivity faster, by 5 percent to 10 percent. Other studies identify several characteristics of digital business that create "dynamic competition and high consumer surplus". Many of these characteristics depend on data as their fundamental lever.

Opportunity exists for tech-based SMEs to play a major role in the data-driven economy. The mobile ecosystem in Nigeria, for instance, was worth an estimated US$8.3 billion in 2017. However, equally important is the impact of the data economy on SMEs in non-tech sectors. It is estimated that half of all job opportunities in middle- and low-income countries are generated by local SMEs.

Which type of digital platforms are likely to lift jobs and growth in the Middle East and North Africa?

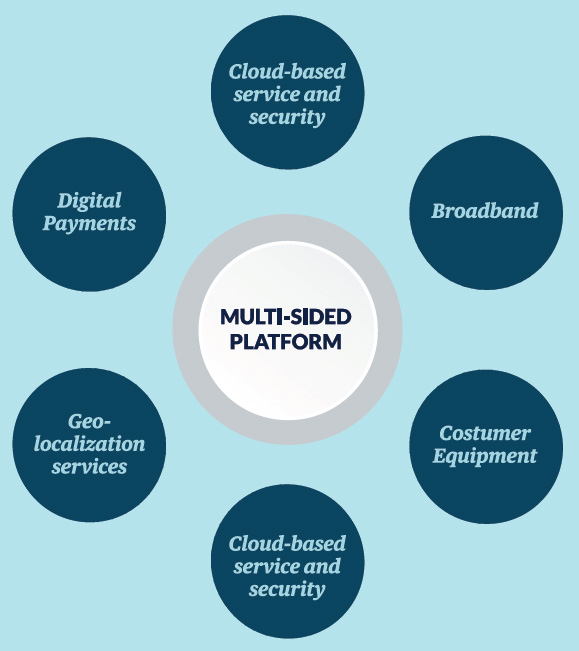

Policy makers will need to pay attention to issues arising around three types of platforms. All of them are essential to the development of the region. This is a tall order. These platforms are:

First, Multi-sided platforms (MSPs), like Careem and souq.com, two regional platforms that are reshaping, respectively, the ride-sharing and ecommerce markets in the MENA Region. In this area, if, on one hand, the MENA region is the home of tech "unicorns" like Careem, Maktoob and Souq.com that have quickly adopted the MSP model and are growing fast, in general the environment around MSP is characterized by regulatory uncertainty. Just as a matter of example, car-sharing platforms are prohibited in Tunisia and Algeria. In markets like Jordan and Egypt, which see a better development of local MSPs, players had to innovate their business model allowing for "cash on delivery" to circumvent hurdles related to the limited development of digital payments among the population. Regulators will need to pay attention to a whole new set of issues, putting stress on the local regulatory agencies, already challenged by the establishment of a level playing field in the digital infrastructure space. Policy makers will need to focus both on the key enabling factors for platforms to grow (Figure 5), and to the establishment of fair competition conditions to emerge.

Figure 6 – Physical factors needed for the growth of digital platforms. Source: Rossotto et al., 2018

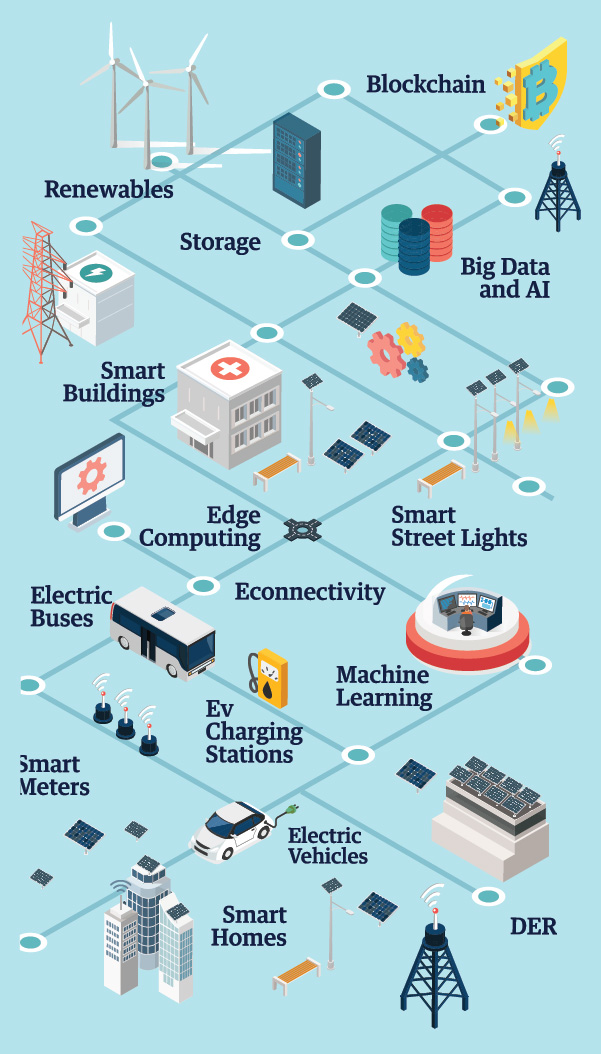

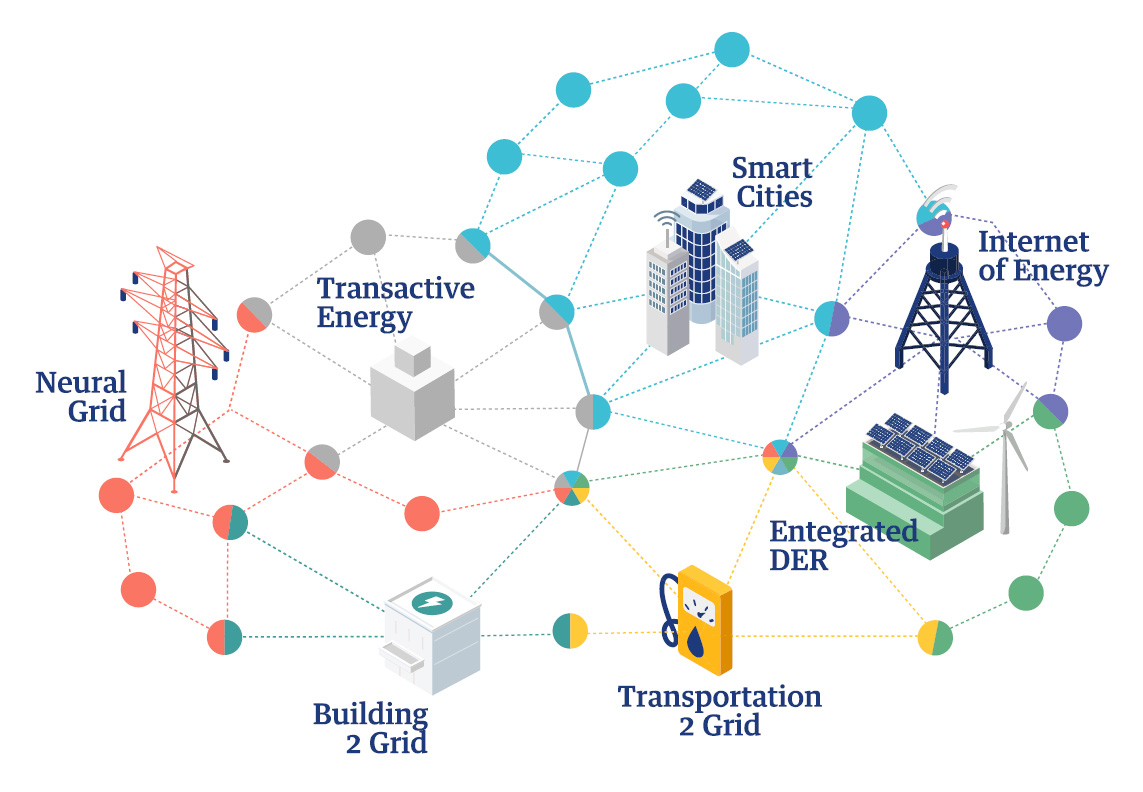

Second, industry and energy digital platforms. Data is completely transforming both industry (through Industry 4.0, robots, IoT, advanced factory automation etc.) and the whole value chain of energy, from upstream drilling all the way to electricity distribution and supply. Crucially, the development of industry 4.0 platforms in plant automation, or the redefinition of energy cloud platform enable a wide ecosystem of small and medium private providers, stimulating the local economies. A rapid modernization process in the key productive sectors of the economies, coupled with rapid digital transformation strategies, can be a true driver of growth for the economies in the region, provided that the skill are also adapted to the new opportunities related to this technological paradigm shift.

Figure 7 – Digital Infrastructure and Energy Ecosystems. Source: Navigant, 2018

Third, national and government platforms will also be important to the development of the digital economy in MENA, especially if coupled with economic reform. For example, the establishment of a national ID platform can be a tool to implement broad-based subsidy reform, or to better target the families in need of economic subsidies and support. Similarly, a national digital procurement platform, coupled with procurement reform and programs to help SMEs participate to the platform, can significantly increase the share of national, smaller firms to the procurement of good and services of the government and of large SOEs.

A New Policy Framework for a New Economy

In an interconnected world, access to and use of digital technologies and data tools has become key to competitiveness, affecting the very chances to survive and develop. Cloud computing allows smaller firms to overcome the barriers associated with the high fixed costs of digital investments, and can help smaller firms rapidly scale up, providing high-power computing resources flexibly via a pay-as-you-go model.

However, a whole new policy framework is needed for the data-driven economy to impact the chances of growth and transformation of MENA.

It seems essential to move to an entirely new way to address technology and the opportunities for disruption. An essential element, for example, will be to embrace, and stop resisting change. Change management at all levels is the needed complement of technology disruption. A common theme, crossing across all types of digital platforms, from private MSPs, to industry and national platforms, is the need to design and implementation national digital transformation strategies, including a wide range of players, from SOEs of the type of energy monopolies, to close oligopolies like banks and telecom operators, all the way to SMEs. Enhancing competition in broadband internet will increase speed and reduce costs, allow for promoting nationwide cloud service markets, and allow to leverage on regional integration to improve Internet connectivity within MENA and between MENA and trading partners.

Well-tailored acceleration strategies, including digital public procurement can cause an acceleration of the model of digital transformation, increasing, for example the participation of digital SMEs. Broad technical training programs, on the model of the Skilling Up Mashreq (SUM) initiative, are necessary to train the technology savvy youth to the opportunities of the data-driven economy.

Figure 8 – Digital Infrastructure and Energy Ecosystems. Source: Navigant, 2018

Carlo Maria Rossotto is Lead ICT Specialist at the World Bank. Read full bio here.

Mona Farid Badran is an Associate Professor at the Faculty of Economics and Political Science, Cairo University. Read full bio here.

End Notes:

1. The article was authored by: Carlo Maria Rossotto, with Mona Badran, Prasanna Lal Das, Elena Gasol Ramos, Eva Clemente Miranda, Martha Licetti and Graciela Miralles.

2. Oxford Economics and Huawey (2017), Digital Spillover. Measuring the true impact of the global economy".

3. London School of Economics, 2013 and 2018.

4. Arezki R. and Ghanem H. (2018), A moonshot for MENA: laying the groundwork for the modern digital economy.

5. World Bank, MENA Economic Monitor "A New Economy for the Middle East and North Africa," October 2018, Washington D.C., USA

6. World Bank. 2016. World Development Report 2016: Digital Dividends. Washington, DC: World Bank. doi:10.1596/978-1-4648-0671-1.

7. The Economist. 2017. "The World’s Most Valuable Resource Is No Longer Oil, but Data." May 6. https://www.economist.com/leaders/2017/05/06/the-worlds-most-valuable-resource-is-no-longer-oil-but-data. Described by The Economist as "Big, Anti-competitive, Addictive and Damaging to Democracy" or BAADD.

8. Bershidsky, Leonard. 2017. "Google and Facebook Too Can Be Disrupted." Bloomberg, December 8. https://www.bloomberg.com/view/articles/2017-12-08/google-and-facebook-too-can-be-disrupted.

9. Munster, Brett. 2017. "Could Blockchain Disrupt Facebook and Google’s Business Model?"

10. OECD 2017. Assessing the Impact of Digital Government in Colombia: Towards a New Methodology: 63.

11. OECD 2017. Assessing the Impact of Digital Government in Colombia: Towards a New Methodology.

12. Bakhshi, Hasan, Albert Bravo-Biosca, and Juan Mateos-Garcia. 2014. "Inside the Datavores: Technical Report." Nesta. https://www.nesta.org.uk/report/inside-the-datavores-technical-report/.

13. OECD 2015.

14. Täuscher, Karl, and Sven Laudien. 2018. "Understanding Platform Business Models: A Mixed Methods Study of Marketplaces." European Management

Journal 3, (3): 319–29.

15. Täuscher, Karl, and Sven Laudien. Understanding Platform Business Models: A Mixed Methods Study of Marketplaces, 10

16. Boateng, Richard, Joseph Budu, Alfred Sekyere Mbrokoh, Eric Ansong, Sheena Lovia Boateng, and Augustus Barnnet Anderson. 2017. "Digital Enterprises in Africa: A Synthesis of Current Evidence." http://believeoverhope.org/pearlrichards/index.php/2017/08/20/digitalenterprises-in-africa-a-synthesis-of-current-evidence/.

17. Matthee, Marianne, and André Heymans. 2013. "How South African SMEs Can Become Better Candidates for Export Finance."Managing Global Transitions 11 (4): 391–407.

18. A list of emerging policy questions for policy makers and regulators in emerging markets.

You must be logged in to post a comment.