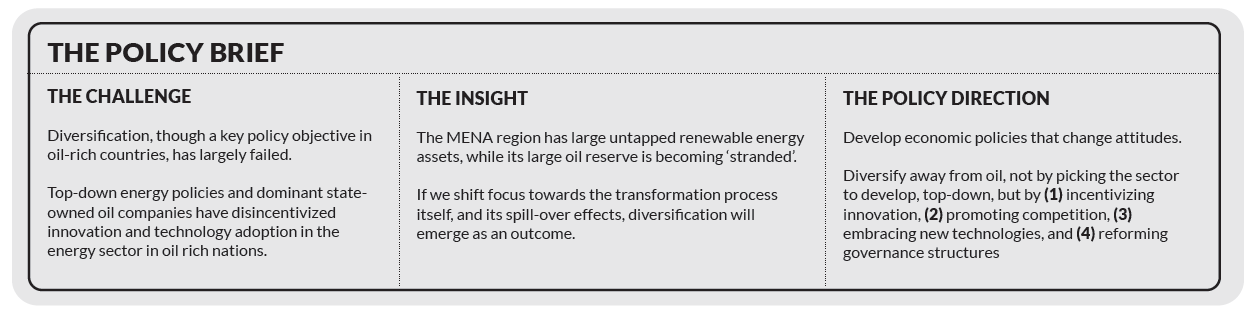

As oil-producing countries look to diversify their economies, they need to focus on transformation and not diversification and on reforming state-owned oil companies in order to embrace the impact of technology on the sector and its potential spillover effects.

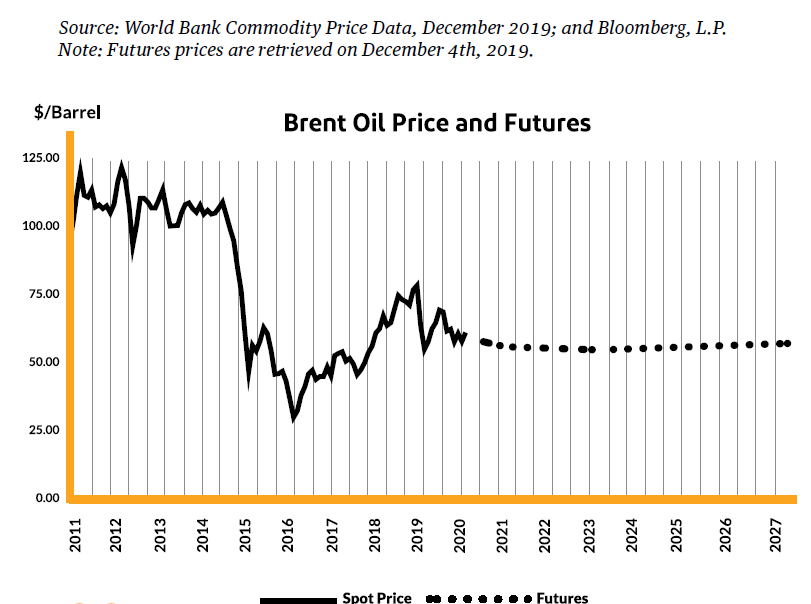

Many oil- and gas-rich countries—including those in the Middle East and Africa, such as Algeria, Nigeria and Saudi Arabia— have either announced or put in place policies to diversify their economies in order to reduce their dependence on oil. The collapse in oil prices—which started in 2014 and is expected to be protracted—has put diversification at the forefront of the policy debate.

Although many fossil fuel exporters understand the need to diversify, few have successfully done so. Historically, diversification away from oil has been difficult for oil-rich nations. In large part, this is because the top-down approach of the state has not given economic leaders and other economic agents the confidence or incentive to embrace new ideas, innovate, and take risks. For example, the incentive structures of state-owned oil companies in many countries around the world, including in the Middle East and Africa, have not consistently encouraged managers and employees to achieve their full potential and adapt to new technologies that are rapidly affecting their industry. Many state-owned companies embark on missions outside their core activities and competencies, innovate little, and struggle to keep talented employees. What’s worse, though they sit on large oil reserves that are relatively cheap to extract, several state-owned oil companies around the world have a heavy burden of debt. As oil-producing countries look to diversify their economies, they need to focus on transformation and not diversification and on reforming state-owned oil companies in order to embrace the impact of technology on the sector and its potential spill-over effects.

Shift in Focus

If countries were to shift their focus from the end goal, diversification, to how to get there—that is, to the transformation process they might find it easier to diversify. The effort involves steps to shift away from the dominant oil and gas sector. A focus on transformation involves an approach to the hydrocarbon sector whose effects can spill over to, and even help foster, sectors outside hydrocarbons. That is, by embracing transformation, countries can focus on getting incentives right for managers and other economic agents including consumers, and turn the technology and innovation energy markets that they now see as disruptive enemies into productive friends. Countries that take a transformation approach are less likely to stumble or resist change.

Technological changes in energy markets can help drive the sustainability of economies that depend on oil revenues. More agile economic systems with appropriate corporate governance structures that empower managers and employees including by limiting potential conflict of interest between stakeholders and managers can more easily take advantage of new technology to mitigate risks associated with potential disruptions in energy markets and even create economic opportunities. For example, publicly listed companies have tended to fare better than state-owned (or even privately owned) companies. Because

these companies are accountable to shareholders, they are more likely to adapt to new circumstances and stay ahead.

At the country level, the lack of government accountability combined with state ownership of the oil sector has exposed countries to considerable risk. The sector is largely resistant to changes in energy-producing and energy-using technologies that can dramatically affect energy markets.

One example, from the energy producing side of things, is the advent of the combination of hydraulic fracturing—often called fracking—and horizontal drilling. This technique made production of oil from shale much simpler, which changed the dynamic of the oil market. Shale oil, whose output can be shut on and off much more quickly and cheaply than that of standard drilling, will eventually lead to shorter and more limited oil-price cycles as output speeds up when prices rise and slows when they fall. The rapid increase in the production of shale oil to 5 million barrels a day in a global market of 94 million barrels a day has also arguably contributed to the oil supply glut that led to the collapse in oil prices.

Another example involves changes in energy using technology. As use of hybrid and electric cars grows, the transportation sector will rely increasingly on the electricity sector and vice versa, and the role of oil products will diminish. That’s bad news for oil, whose main use has been for transportation through products such as gasoline, diesel, and jet fuel.

Technological change will also spur competition from other sources of energy, such as natural gas, and eventually, renewables, such as solar and wind. Technological change is, of course, related to energy prices or, more generally, to the need to innovate for example, when the security of energy supply is at stake as it was during the oil crisis of the 1970s.

The so-called peak-oil hypothesis, developed in the mid-1950s, posited that global oil production, limited by geological reality and the ability to extract oil, would top out around 2020. For years, the hypothesis seemed on target. But as production was supposed to be nearing its peak, the shale revolution started to take off. In many respects, this revolution, and the surge in supply it triggered, can be viewed as a response by oil supply markets to high prices in the 2000s, driven by China’s economic expansion and the ensuing greater market for oil. It was a direct challenge to the overly pessimistic peak-oil view that geological factors would limit supply.

It is unclear, however, to what extent the lower prices ushered in by the shale revolution will delay the transition away from oil use in the transportation sector. There is, in fact, evidence that firms in the auto industry tend to innovate more so-called clean technologies when they face higher fuel prices.

The Fate of Oil in MENA: The ‘Stranded Assets’ of 260 Billion Barrels of Oil

Understanding the role of technological change in energy markets is important because such change does much to determine the fate of oil and of the countries and companies that depend on it.

The transition toward lower-carbon or carbon-free energy (such as renewables) is a major goal, that is imperative if climate change is to be contained, and can have major impact on oil-rich countries at least during the transition. Reduced demand for carbon-rich fuels such as oil will make it uneconomical for these countries to tap their reserves—turning those reserves into so-called stranded assets.

The historic 2015 Paris Accord to limit the rise in global temperature to less than 2 degrees Celsius accentuates the transition away from fossil fuels fostered by changes in energy-producing and energy-using technologies (such as renewables and electric and hybrid cars). There is evidence that a third of oil, half of gas, and 80 percent of coal reserves will be kept in the ground forever if the goals of the accord are reached. Among those severely affected would be the Middle Eastern oil-producing nations. About 260 billion barrels of oil in the Middle East cannot be burned if the world is to reach its warming goal. In addition to the oil, equipment and other capital used to explore and exploit those reserves could also become stranded.

And the amount of potentially stranded assets is growing. Recent giant discoveries of oil and gas (Egypt, Israel, Lebanon) are expanding the list of countries whose oil and gas assets may never make it out of the ground. With so many countries exposed to the risk of stranded assets, it is a priority for governments and businesses to diversify to help adapt to and mitigate this risk.

Reducing Carbon: A Blessing in Disguise

In any quest for diversification, reducing the carbon component in energy will be beneficial because it gives countries great opportunities to harness the potential of relatively untapped renewable resources. The Middle East and Africa region is not only endowed with vast oil reserves, it also has large and largely untapped renewable resources. Indeed, every six hours the sun delivers to the world’s deserts more energy than the planet consumes in a year, according to DESERTEC—an initiative whose vision of a global renewable energy plan involves harnessing sustainable power from areas with abundant renewable sources of energy. Studies by the German Aerospace Center demonstrated that the desert sun could easily supply enough power to meet rising demand in the Middle East and Africa while also helping to power Europe.

Solar power and other renewable energy assets give countries in the Middle East and Africa the opportunity to offset the risk of stranded oil and gas assets. Solar radiation is indeed highest in that region—along with parts of Asia and the United States—according to the US National Aeronautics and Space Administration.

These non-oil and gas resources can help address the rapidly growing electricity demand of an expanding population in the Middle East and Africa. However, in order to harness the power of renewables, the region needs improved and expanded infrastructure, a better-educated population, a strong state, and appropriate incentives to motivate economic managers and entrepreneurs to adopt existing frontier technology. Several countries have already embarked on ambitious projects to increase their renewables sector. The United Arab Emirates, for example, wants 24 percent of its primary energy consumption to come from renewable sources by 2021. Morocco has unveiled the first phase of a massive solar power plant in the Sahara Desert that is expected to have a combined capacity of two gigawatts by 2020, making it one of the largest solar power production facilities in the world.

Getting the Process Right

The decline in oil and gas prices makes transformation imperative. The adage that "necessity is the mother of invention" seems to have a particular resonance for oil-rich countries in the Middle East and Africa, which have been shaken by the decline in oil prices and recognize that they must develop resilient economies that can withstand fluctuations in energy markets. Dubai, for example, facing the depletion of its oil reserves, transformed itself into a global trade hub. Countries and businesses reliant on these markets, and the revenue they generate, must formulate policies to address risks and embrace opportunities presented by transformation.

Institutional factors, such as corporate governance, legal systems, contestable markets (those in which there are no barriers to entry and exit) and patronage spending in state-owned companies affect attitudes toward innovation and openness to new ideas and, therefore, the process of transformation in oil-rich countries. For example, large public sector employment financed by oil revenue has stifled the impetus for innovation. Economic policies that are not geared toward changing attitudes are unlikely to deliver the needed transformation agenda for oil-rich countries.

Saudi Arabia—the region’s, and perhaps the world’s, most important oil producers seems aware of the need to augment the longtime source of its riches with non-oil income. As part of its ambitious plan to transform its economy, the country announced a public offering of 5 percent of the state-owned oil company, ARAMCO. This appears to be a step toward emulating publicly owned Western companies, such as Exxon, which once concentrated on oil, but broadened their focus to become energy companies, balancing their oil assets with other forms of energy.

The focus on the end goal of diversification has too long kept countries in the Middle East and Africa from getting the process right. Transformative policies should move away from top-down approaches that pick which sectors to develop. Instead, they must develop an environment that promotes market contestability and changes the incentives for tech-savvy young entrepreneurs and leaders in all sectors, and helps them, their firms, and ultimately the whole economy reach their potential.

Rabah Arezki is the Chief Economist for Middle East and North Africa Region (MNA) at the World Bank and a senior fellow at Harvard Kennedy School. Read full bio here.

Smart Cities.. The Policy Catalyst for Sustainable DevelopmentAugust 7, 2020 7:00 pm

[…] (Fyson, Lindberg and Morales, OECD). Moving ahead towards a sustainable future will also require painful economic transformations and trade-offs (Arezki, World Bank). These command adopting agile governance approaches and taking painful steps […]